As technology continues to advance and change the way we interact with the world, the idea of a cashless society has become increasingly popular. A cashless society is one where all transactions are made using digital forms of payment, such as credit cards, mobile payments, or cryptocurrency, eliminating the need for physical currency.

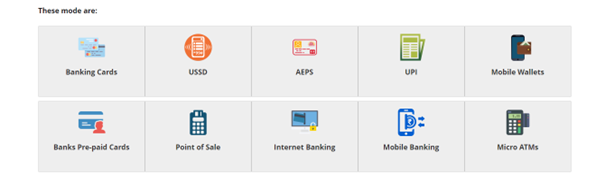

The Government of India has started the “Digital India” programme to ensure that its services are made electronically accessible to its people through better online infrastructure, increased Internet connectivity, or the empowerment of the nation in the digital sphere.

Digital India promotes “Faceless, Paperless, Cashless”.

While there are certainly advantages to a cashless society, there are also several potential downsides to consider. In this blog, we will explore the pros and cons of a cashless society.

Pros:

- Convenience: One of the primary benefits of a cashless society is the convenience it offers. With digital payment methods, you can make purchases quickly and easily without having to carry around cash.

- Reduced Crime: A cashless society could help to reduce the incidence of theft, burglary, and robbery. Without cash on hand, there would be less incentive for criminals to target individuals for their money.

- Improved Record-Keeping: Digital payment methods make it easy to track and monitor transactions, which can be useful for both individuals and businesses. This improved record-keeping can help to reduce fraud and make accounting and taxes easier.

- Better Access to Financial Services: In a cashless society, individuals who do not have access to traditional banking services may find it easier to access financial services through digital payment methods.

- Increased Efficiency: Digital payment methods can speed up transactions and reduce wait times, leading to increased efficiency in businesses and other organizations.

Cons:

- Exclusion: While digital payment methods are convenient for many people, there are still some individuals who may be excluded from participating in a cashless society. This includes people who do not have access to technology, people who do not have a bank account or credit card, and those who are simply uncomfortable with the idea of using digital payment methods.

- Privacy Concerns: Digital payment methods require the sharing of personal information, which can lead to concerns about privacy and data security. There is also the risk of digital payment systems being hacked or compromised.

- Fees and Charges: Digital payment methods often come with fees and charges, which can add up over time. This can be a disadvantage for people who are already struggling to make ends meet.

- Dependence on Technology: A cashless society would be entirely dependent on technology, which could be problematic if there are ever issues with the technology or if there is a power outage or other disruption.

- Potential for Increased Debt: Without the tangible nature of cash, it may be easier for people to overspend and accumulate debt, leading to financial difficulties in the long run.

Conclusion

In conclusion, a cashless society has the potential to offer many benefits, such as increased convenience, improved record-keeping, and reduced crime. However, there are also potential downsides to consider, such as exclusion, privacy concerns, and the potential for increased debt. As with any significant change, it is essential to carefully weigh the pros and cons before making a decision.