Software programmes known as financial and accounting tools assist businesses in managing their financial transactions, recordkeeping, and reporting. These tools can aid organisations in streamlining their accounting procedures, minimising errors, and producing data-driven decisions based on precise and current financial data.

How Financial/Accounting Tools are useful for businesses?

Examples of financial and accounting tools and how they can benefit businesses are provided below:

Accounting software: Accounting software can assist companies in managing their financial activities, such as payroll, billing, and invoicing. This can provide accurate and up-to-date financial information for tax and financial reporting purposes while also saving time and reducing errors for businesses.

Tools for forecasting and budgeting: Tools for forecasting and budgeting can help businesses plan and monitor their financial performance, including revenue, costs, and cash flow. Informed decisions about resource allocation, investment opportunities, and risk management can be made by businesses with the help of this.

Software for tracking expenses: Software for tracking expenses can assist businesses in keeping track of their receipts, claims for reimbursement, and expense reporting. Businesses can benefit from this by minimising errors, ensuring compliance with tax and regulatory requirements, and managing their cash flow more effectively.

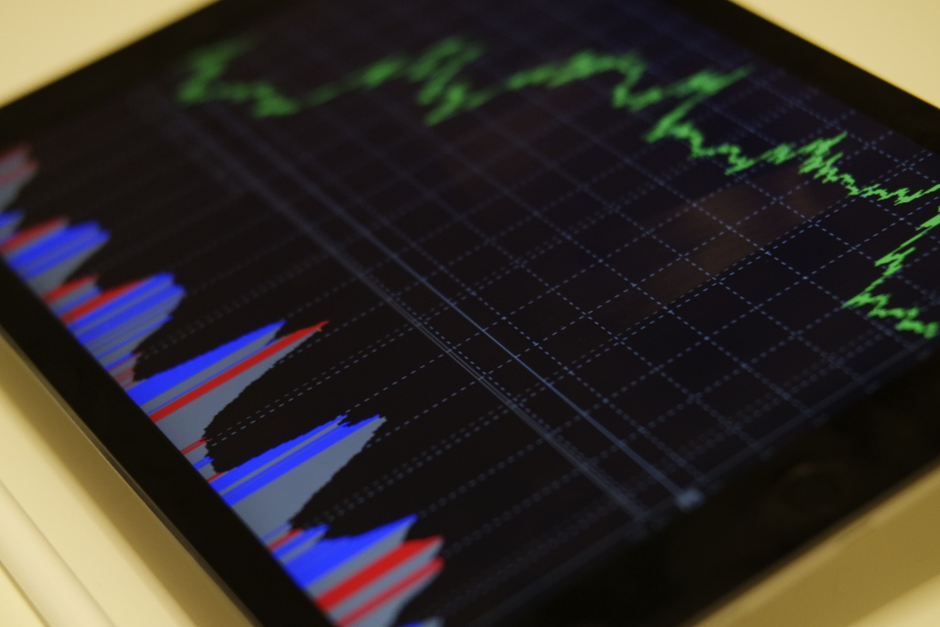

Financial analysis tools: Financial data, such as revenue, expenses, and profitability, can be analysed and visualised by businesses with the aid of financial analysis tools. In order to improve their financial performance, businesses can use this to recognise trends, opportunities, and risks and to guide their decision-making.

Conclusion

In general, accounting and financial tools can be a useful resource for companies looking to manage their finances more skillfully. These tools enable businesses to optimise their financial performance for long-term success by streamlining accounting procedures, lowering errors, and making wise financial decisions.